The aim of this blog post is to clarify different options of how to organize European deposit insurance without yet settling on the best option. We aim to explain and to highlight what different options can and cannot achieve. We end by drawing conclusions on potentially adequate quid-pro-quo measures for different forms of deposit insurances given the problem of transition. This post was first published by Bruegel.

The five presidents’ report on Completing Europe’s Economic and Monetary Union in June this year called for European Deposit Insurance to complete the Banking Union. European Council President Tusk also called for completing banking union by creating a European deposit insurance and he argued that this could be done without treaty change. A German “non-paper”, on the other hand, argued that a “discussion on further mutualization of bank risks through a common deposit insurance or an European deposit reinsurance scheme is unacceptable” unless a number of other measures are taken earlier that would render bail-in more likely, reduce the exposure of banks to sovereigns and reduce the link between banks and sovereigns. The non-paper also considers treaty change indispensable.

Reducing the link between banks and sovereigns is indeed a key issue that banking union aims to achieve. In the supervisory dimension, the SSM has already achieved a rather strong separation of banks from national pressures exerted through supervisors. However, one of the reasons for the ongoing debate of national vs European competences in supervisory matters relates to the treatment of deposits in the case of failure. As long as the national governments and national deposit insurances are the back-stops to banks, the link between banks and sovereigns continues to be strong. As a result, national authorities will demand a special role in the supervision of “their” banks. Recent conflicts between Germany’s approach to shift some authorities from the supervisor (i.e. the SSM) to the German finance ministry and the ECB’sassertion of its supervisory mandate are one potential case in point. Banking union therefore remains incomplete. Consequently, banks risk, funding costs, and performance of banks will depend on national policies.

A European deposit insurance is one of the many indispensable part of a complete banking union. We would argue that policy makers should broaden the debate on deposit insurance with the institutional question of bank resolution. Conceptually, it would make sense to combine a Single Deposit Insurance with the Single Resolution Fund and let it be administered by an enlarged Single Deposit Insurance and Resolution Board. The US FDIC and the Japanese Deposit Insurance Corporation also combine the functions of resolution and deposit insurance.

The aim of this blog post is to clarify different options of how to organize European deposit insurance without yet settling on the best option. The policy discussion on deposit insurance is, characterized by unclear conceptual representations. We aim to explain and to highlight what different options can and cannot achieve. We end by drawing some tentative conclusions on potentially adequate quid-pro-quo measures for different forms of deposit insurances given the problem of transition towards a more integrated banking market (transition problems) and potential further harmonization of other national policies.

A key issue to consider is whether and to what extent a European Deposit Scheme mutualizes risks of losses on depositors across borders or merely serves as a credit line to various national deposit insurance schemes. Risk sharing across borders is important to ensure that funding conditions for banks across the EU do not depend too much on the location of the bank.

Deposit guarantees are currently national schemes. Their credibility depends on the amount of paid-in resources, the health of the banking sector in the country concerned and the health of the public sector, that serves as a back-stop to the national deposit guarantee. In particular, the deposit guarantee scheme directive, DGS, foresees that, if necessary, banks have to pay additional contributions to the national deposit fund. Moreover, if the fund is depleted in case of a large pay-out, the national deposit fund would typically get a loan from the national government.

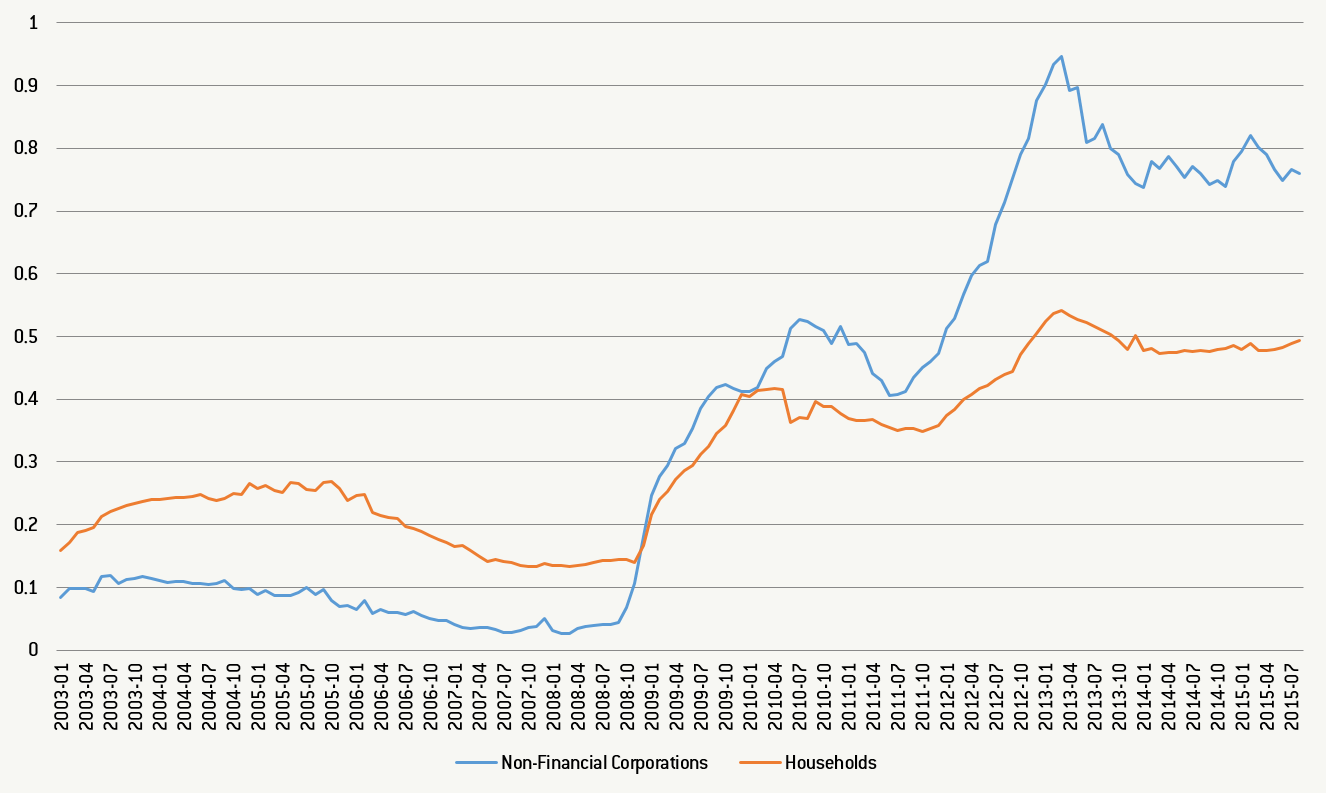

Funding costs for banks, i.e. deposit rates, are therefore different across euro area countries. The chart shows the standard deviation of deposit interest rates normalized by the German interest rate on deposits. (It is a coefficient of variation where the normalization is the rate of the large country with the lowest rate. Normalization with the average rate shows even an increase in the coefficient of variation but is misleading as since the decision to start banking union, deposit rates have come down in the periphery, driving down the average rate). It has come down in the last years but it is still higher than in the pre-crisis years. This suggests that location of banks in the euro area is a significant factor determining the riskiness of banks’ deposits.

Figure: Standard deviation of interest rates on deposits from non-financial corporations and households normalized by the German rate

Note:The normalized standard deviation was calculated as the standard deviation of interest rates on outstanding amounts across Eurozone countries in a given year divided by the German interest rate in the same year.

Source: ECB Statistical Data Warehouse, Bank interest rates – deposits from non-financial corporations and households (on outstanding amounts)

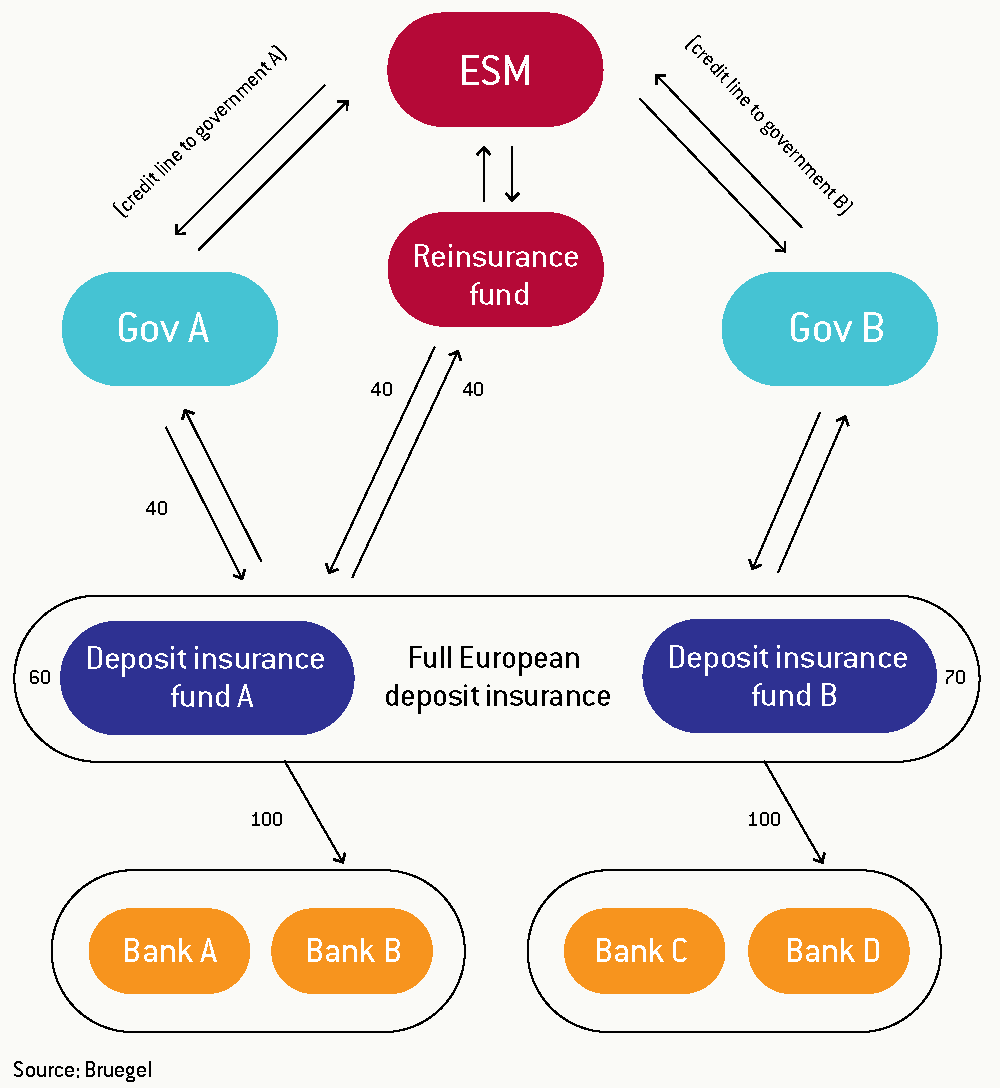

The debate on deposit guarantees is also quantitatively important. Deposit in different euro area countries often exceed 100 % of GDP. Also covered deposits amount to very significant percentages of GDP as can be seen in the chart below. The magnitude of such deposits also renders it obvious that build-up insurance funds can only partly cover losses in case one of the large, systemic banks with a large deposit base suffers from massive losses. This is why deposit insurances rely on explicit or implicit fiscal backstops.

Figure: Back-stops to national deposit insurance schemes

Options

- The first proposal is to provide liquidity to a national deposit insurance scheme when it runs out of money due to a mid-sized or large bank failure. Figure 1 illustrates the example of a deposit insurance scheme with a fund of 60, while the deposit insurance payouts on an (imaginary) failed bank amount to 100. The scheme could refinance itself with a credit line from the national government A, which will be paid back from future deposit insurance premiums on banks. If the government of country A cannot provide the funding, it could borrow from the European Stability Mechanism (ESM). This option already exists now and is somewhat comparable to what Spain did to stabilise its banking system in 2012. However, ultimately this is just a liquidity line and the losses will remain in the country, as the national banks and taxpayers have to repay the ESM loan by future deposit insurance premiums. It therefore does little to cut the link between banks and their sovereigns.

- An alternative would be a credit line to the national deposit insurance from a supranational fund such as the ESM or a European deposit insurance fund. Again, this would ultimately keep the losses with the national banking system and not break the link between banks and sovereigns.

- A third proposal, advocated strongly by Gros in 2013 and, as a crisis measure, by Véron in 2012, is to create a re-insurance scheme. The national deposit insurance schemes would remain in place, but they reinsure themselves in a European fund in case the deposit insurance payouts exceed the national fund. This would amount to an insurance against large, systemic shocks. Gros points out that such a scheme needs to be compulsory to avoid adverse selection and that the national DGS would have a first-loss tranche to bear. As usual with re-insurance, the national schemes pay a premium for this cover of extreme risks. Such risk-premia could be country-specific, which would introduce country differences, or European. Such a re-insurance protects against tail risk and is therefore a true insurance that spreads large losses beyond national borders. For the smaller risks, the national funds would need to be re-financed by extra premiums on the remaining national banks. It should be noted, that introducing a re-insurance, however, does not fully solve the problem of fiscal back-stop. In fact, for larger systemic risks, even a re-insurance is unlikely to cover the entire potentially affected deposits. A re-insurance would therefore also have to be able to draw on a fiscal backstop such as the ESM.

- The fourth proposal is to create a European deposit insurance fund. This fund would cover potential deposit insurance payouts, while the premiums would be equally spread over the participating Eurozone banks. Re-insurance is no longer needed, as a European fund is larger and can thus cover the failure of a few mid-sized banks or one or two larger banks. Nevertheless, a credit line from the ESM will be useful, similar to the credit line of the US Treasury for the Federal Deposit Insurance Corporation (FDIC).

Assessment

So how do these schemes compare overall? We do not consider options A and B as a European deposit insurance scheme. Rather, they constitute credit lines that enhance the credibility of the national deposit insurance schemes but they do not insure risks other than liquidity risks across borders. Markets would still differentiate between a bank’s country of origin. Banks from countries with weaker government finances would pay higher funding costs. Our contention is that this differential will remain in the first two proposals, as the deposit insurance arrangements remain basically national. Moreover, the governments will still want to top up the single supervision of the ECB with national supervision, because of the exposure of the national deposit insurance scheme to a domestic bank failure.

A deposit re-insurance scheme, however, has a number of advantages and disadvantages. The advantages of this scheme are clear. It would recognize that currently some banking policies remain national. The first loss would remain with the national schemes in order to reflect the fact that some national policies matter for bank performance. For example, loan-to-value ratios for mortgages differ across Europe and thus influence the riskiness of mortgages on bank balance sheets. The disadvantage, however, is that country differences for banks would remain significant. In particular, national supervisors would rightfully want to have a special supervisory relation with the banks for which their national deposit insurance would have to take the first loss.

Moreover, the percentage that is national in the insurance is an important variable driving the effectiveness of the scheme. If the national percentage is high, significant differences between countries’ banking systems would remain, in particular as the national depositors would have the responsibility of re-financing the fund after a bank rescue. In fact, a large national component could even introduce an element of significant vicious circles as the failure of one bank would make deposits in other banks more costly due to the increased levy. In contrast, if the national first-loss tranche is rather small, the system moves closer to a system in which it resembles a European deposit insurance, option D.

By contrast, the fourth proposal would provide for Eurozone wide risk sharing. In that way, bank funding costs would still be different according to a bank’s solvency position but no longer by its location of headquarters. The advantage of such a scheme would be that the quality of deposit insurance would be equalized across countries. Such a scheme would also best correspond to a centralized supervision by the SSM and could be compulsory for all the banks directly supervised. However, the scheme would also require that other national policies cannot be used in a way so as to free-ride on the European insurance, creating potentially significant moral hazard problems.

Conclusion

To conclude, a genuine banking union that fulfils the aim of “breaking the vicious circle between banks and sovereigns” would require option D. This option, however, raises questions as regards transition problems as well as governance when some national policies remain in place. Before providing such a full European deposit insurance, it is certainly necessary to reduce the national sovereign risk on banks’ balance sheets, for example by introducing some form of large exposure rules. Also, a full European deposit insurance would require a European fiscal backstop.

In contrast, option A and B would not per se justify any move in the direction of large exposure rules as the national sovereigns remain the ultimate back-stops.