(Auch auf Deutsch auf Makronom)

When created two decades ago, the euro immediately became the world’s second most important currency. But it has remained a distant second to the US dollar. Its internationalisation peaked in 2005 and went into reverse with the euro crisis, never fully recovering since. Although some predict the demise of the dollar, its global hegemony persists.

Faced with a United States administration less inclined towards multilateral solutions and willing to use its currency to extend its domestic policies beyond its borders (for instance by forcing European firms to cut ties with Crimea, Cuba or Iran), the European Union is considering promoting a greater international role for the euro. Regular attention is now paid to it in policy speeches, in particular in the context of the European Commission’s stated desire for the EU to play a more strategic geopolitical role. The European Central Bank, meanwhile, has abandoned its traditional neutral stance on this question.

Pros and cons of a dominant currency

Despite being an international currency, the euro is not a dominant one. Does this matter and would it be beneficial for the EU if the euro had a greater international role? As a dominant currency, the dollar enjoys certain advantages: seigniorage revenues from the significant holdings of cash abroad (as long as rates are positive); lower yields for the government from a safety and liquidity premium; an aggregate return on foreign assets superior to the cost of foreign liabilities; lower transaction costs for its citizens and companies; a competitive advantage for domestic banks which issue international currency; a lower dependence on the US driven global financial cycle; and an additional geopolitical instrument to ensure financial and economic autonomy.

However, a dominant currency also entails costs. In times of global uncertainty, the dominant currency needs to provide some form of insurance to the rest of the world in two ways. First, the appreciation of the dominant currency, caused by an increase in demand for a ‘safe’ currency during times of uncertainty, can lead to negative wealth effects for the country if its debt is denominated in the dominant currency but its assets are invested abroad in local currencies. Second, to avoid the collapse of the global financial system, the central bank issuing the dominant currency needs to play the role of international ‘lender of last resort’ (e.g. via currency swap lines with other central banks), which could interfere with its domestic policy objectives. Finally, to achieve the status of globally dominant currency, a global safe asset needs to be provided, which results in periods of significant capital inflows that combine with current account deficits.

These cons explain why some countries, such as Germany, were reluctant to promote the internationalisation of their currencies in the past. They feared it could weaken control over monetary policy, generate undesirable exchange rate volatility and result in excessive appreciation of the currency, thus undermining their export-dependent growth model. The euro area and the ECB inherited this pre-euro German position and left the role of the euro to be determined by market forces and other central banks. This is now changing in official communications, but are the steps taken sufficient?

Determinants of global currency status

Historically, countries issuing dominant currencies have been characterised by a large and growing economy, free movement of capital, an explicit willingness to play an international role, stability (monetary, financial, fiscal, institutional, political and judicial), an ability to provide a large and elastic supply of safe assets, developed financial markets, and significant geopolitical and/or military power. How does the euro area measure up?

Thanks to a large economic base, the euro area partially fulfils the first criterion. Though not the foremost global economic power, the monetary union represents one of the largest economic blocs in the world even if it lacks economic dynamism. It also fulfils the second criterion, as free movement of capital is solidly entrenched in European Treaties. The willingness to play an international role was previously not there, but this has changed.

The stability criterion is only partly met in the euro area. Despite missing its inflation target in recent years, the ECB has ensured a stable value of the currency in the last two decades. Financial stability risks, after being at the root of the euro crisis, have been reduced. And most euro-area countries fare pretty well in terms of judicial and political stability, despite some setbacks in some countries in recent years.

Nevertheless, flaws in the architecture of the monetary union have sometimes led investors to doubt its long-term durability, or the irreversible participation of some countries. These doubts came to the fore during the euro crisis and redenomination risks have periodically resurfaced since then, notably in Greece in 2015 and in Italy in 2018. Finally, fiscal stability is a more complex issue in the euro area than in other jurisdictions due to decentralised fiscal and centralised monetary policy. The European Stability Mechanism (ESM) and the ECB’s Outright Monetary Transactions (OMT) programme have addressed this issue to some extent.

However, the euro area does not provide a large and elastic supply of a safe asset. Safe assets are liquid assets that credibly store value at all times, in particular during systemic crises, and there is a high demand for them. Sovereign debt securities from advanced countries play this role, as long as public finances are considered sound by the markets.

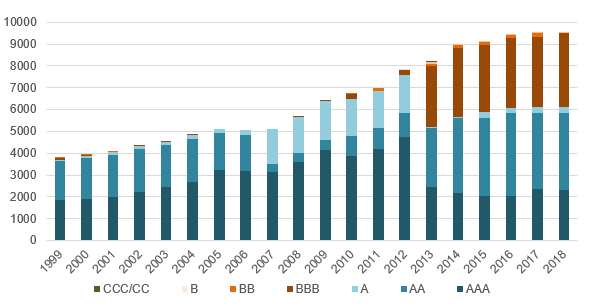

From the creation of the euro to the euro crisis, sovereign bonds from euro-area countries enjoyed this status – but several lost it during the euro crisis. The stock of AAA-rated debt securities from the euro area declined from around 40% of its GDP in 2008 to 20% in 2018 (Figure 1), while the supply of AAA-rated US Federal debt securities increased from 65% of GDP to more than 100%.

Figure 1: Supply of safe assets from the euro-area (€ billions)

Source: Bruegel based on Bloomberg for bonds issued by EFSF, EU, ESM and EIB, S&P for credit ratings and Eurostat for government debt securities. Note: includes bonds issued by the 19 euro-area countries, the European Financial Stability Facility, the European Union, the European Stability Mechanism and the European Investment Bank.

As far as the development of financial markets is concerned, the euro area’s capital markets are much less developed, less liquid and less deep than in the US. They are still heavily fragmented along national lines, despite the Capital Markets Union initiative. Finally, even though Ursula von der Leyen’s European Commission considers itself a “geopolitical Commission”, the EU is far from being a dominant military power.

No shortcut to dominant status

Overall, the monetary union does not meet all the criteria for the euro to become a dominant currency. The only solution is to improve the institutional setup of the monetary union. Besides completion of the banking union and the deepening of capital markets, the supply of safe assets is essential. It is also crucial to boost growth in order to make the euro area an attractive destination for investment, but also to improve the prospects of individual countries so that their debt is considered safe. Finally, a more determined attitude on the part of the ECB (by offering more easily currency swaps to countries in which euro liquidity is important) would help, as would progress on an EU external/defence policy and a more visible geopolitical role.

Current minor initiatives put forward by the European Commission – promoting the labelling of energy contracts and derivative clearings in euro, or encouraging the systematic use of the euro by institutions such as the European Investment Bank (EIB) and the European Bank for Reconstruction and Development, or by third countries through diplomacy – are useful, but insufficient.

Two issues should now be prioritised.

The increase in the supply of safe assets during the COVID-19 crisis

Significant steps have been taken to ensure that the supply of euro-denominated safe assets is increased. First, the ECB’s Pandemic Emergency Purchase Programme has ensured the stability of the monetary union by allowing governments to issue debt easily, thereby also increasing the supply of safe assets. Second, the Eurogroup agreed on 9 April 2020 to increase joint borrowing by up to €540 billion: €200 billion through the EIB, €100 billion through the new EU ‘SURE’ credit line to help countries finance temporary lay-off benefits and up to €240 billion through the ESM. Third, the European Council reached an agreement on 21 July 2020 to issue up to €750 billion-worth of EU debt to finance its recovery plan, using the EU budget as a mechanism for borrowing.

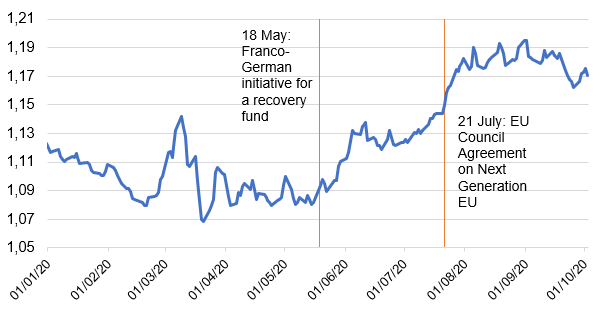

As the fall in sovereign spreads shows, markets have interpreted these decisions as a commitment by EU countries to stick together, and as an improvement in the institutional set-up of the Economic and Monetary Union. This should increase its stability and reinforce the international role of the euro. The euro indeed appreciated when the €750 billion package was agreed, and when France and Germany made the initial proposal in May (Figure 2).

Figure 2: US dollar – euro exchange rate

Source: Bruegel based on Board of Governors of the Federal Reserve System.

It is now of central importance that the agreed package clears its final legislative hurdles. Strong governance mechanisms will also bolster the credibility of the package. An important discussion is about the issuance of green bonds (as well as social bonds), and whether they represent an opportunity to create a new market with Europe in the lead, or rather a disruption that would fragment the market for EU bonds. Finally, the EU should reconsider whether it is sensible to pay back the debt as originally planned or if it is preferable to roll it over when it matures. Repaying the debt would not only be a major economic burden without benefit but would also counteract the strategy to boost the international role of the euro.

Promoting the euro by boosting growth

An ambitious and strategic growth agenda for the next decade is also needed. Policymakers must ensure that funds from the recovery plan are used wisely to reboot the European economy once the coronavirus is defeated. This will provide a double dividend for the euro as an international currency by increasing the euro-area’s attractiveness and by boosting ratings of weaker countries, thus increasing the overall supply of safe assets.

The EU recovery fund will be particularly crucial in that regard. It should complement national stimulus measures to prevent a slow recovery, but given the usual sluggishness in the disbursement of EU funds, its macro effect will only start to materialise in a couple of years. That’s why the recovery fund should mainly aim at establishing a new growth model in Europe and focusing on the necessary reforms.

Overall, the euro is not yet set to dominate as a global currency as long as no major further institutional steps are taken. There is no shortcut to becoming a dominant currency.