The European Union wants to reduce reliance on imported defence equipment, but the reliance seems to be overstated. Our analysis for Bruegel

The European Defence Industrial Strategy (EDIS), published in March 2024, proposes that European Union countries should aim to procure at least 50 percent of their defence needs from within the EU by 2030, rising to 60 percent by 2035. According to the strategy (European Commission/High Representative, 2024) only about 20 percent of defence purchases since 2022 have been acquired from EU providers, while weapon and ammunition imports have increased substantially since the start of Russia’s war of aggression against Ukraine (Wolff, 2024).

The mooted 50 percent target might not be feasible in the short-term, given the current need for rapid procurement of ammunition and weapons, but there is some logic behind it in terms of medium and long-term industrial policy goals. Directing demand to European producers could boost the EU’s defence technology and industrial base (EDTIB), especially for new technologies with significant knowledge spillovers or in case of clear security reasons (Wolff, 2024).

In moving towards the target however, a basic question must be asked: what share of defence equipment do EU countries currently procure from their domestic suppliers, other EU countries and the rest of the world? Perhaps surprisingly, EDIS does not provide a convincing answer.

It states that “78% of the defence acquisitions by EU Member States between the start of Russia’s war of aggression and June 2023 were made from outside the EU” and refers as a source to Maulny (2023). Maulny (2023) in addition estimates that the US provided 63 percent of either EU military equipment imports between February 2022 and June 2023, or 63 percent of total military equipment purchases – the paper is ambiguous on this. It provides neither a source for its numbers nor a methodology for how they were obtained.

How much does the EU spend on weapons imports?

We looked at the value of military equipment imports as a share of total expenditure on military equipment for selected countries (Figure 1). The data suggests that military equipment spending goes primarily to domestic producers, with imports typically being below 10 percent of all spending. This small share of imported military equipment reflects a home bias and also shows the rather low level of intra-EU trade for military equipment. Moreover, producers with European production sites might still be non-EU companies.

Figure 1: Imports as share of defence equipment expenditure, selected countries

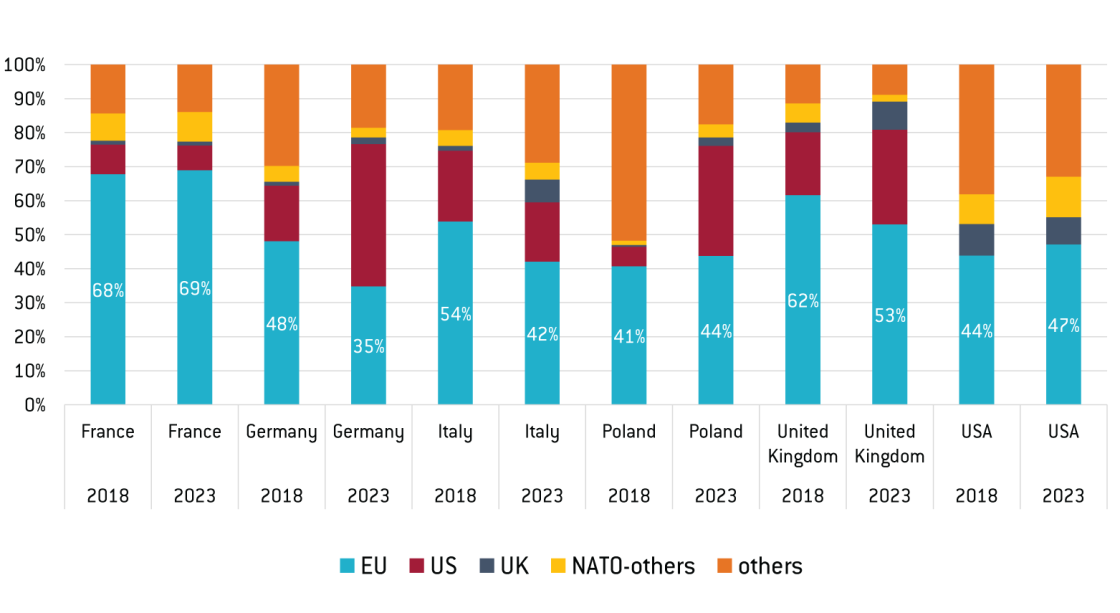

We then analysed the distribution of imports of weapons for all EU countries, the United Kingdom and the United States, calculating shares of arms and ammunition imports from 1) intra-EU, 2) US, 3) UK, 4) other NATO (non-EU-UK-US) and 5) others. For no country in the EU does the US represent 60 percent of their arms and ammunition imports let alone of their total defence purchases, while for most EU countries, intra-EU imports are dominant among imports.

Figure 2 shows the split of arms imports by the five categories of countries for the main European military stakeholders (including the UK). The data also shows that for each of these five European countries more than 70 percent of their arms imports came from NATO allies in 2023, which should partially alleviate fears of dependence on foreign military suppliers.

Figure 2: Arms imports by origin for selected EU countries, the UK and US

The data we used (UN Comtrade) might not capture all military imports, so we also looked at data reported by the French and Spanish national defence agencies, covering military imports up to 2022 and 2021 respectively.

In 2022, France’s military imports came mostly from Europe (about 70 percent), with the EU alone accounting for almost 60 percent of total imports. The Americas (the entire region, north and south) accounted for only about 10 percent of the total (Ministère des Armées, 2024). The pattern was similar for Spain. In 2021, EU countries provided 76 percent of the total military equipment imports into the country, while the US provided 6 percent. When including the UK, European providers supplied 80 percent of Spain’s total military imports (Ministerio de Defensa, 2023).

The numbers seem to show that the picture of reliance on providers from outside the EU given by the European Commission in EDIS is inaccurate. In fact, the 50 percent goal for military purchases from within the EU is already being met – comfortably. Even if the current situation is pushing up defence imports from outside the EU, it is likely that this trend will reverse once the urgent need for weapons because of Russia’s invasion of Ukraine is over.

We also looked at a forthcoming database that compiles procurement data 1 from national defence ministries (Wolff et al, 2024). Figure 3 shows German military spending from 2020 to 2024. Again, the vast majority of Germany’s military spending goes to domestic producers. Non-European producers only acquired a larger role in the last two years.

Figure 3: military procurement in Germany by origin, 2020-2024

Source: Wolff, et al (2024)

EDIS (European Commission/High Representative, 2024) also cites Fiott (2019), according to which “over 60 percent of the European defence procurement budget was spent on non-EU military imports” between 2007 and 2016. We were unable to find such a number in Fiott (2019), though the paper does say that “Indirect cross-border transactions under the Directive [on coordination of procedures for the award of defence and security contracts, 2009/81/EC] accounted for 40 percent of all contracts from 2011 to 2015”. Direct orders from foreign firms from 2011 to 2015 only accounted for “€3.1 billion out of a total of €30.36 billion” (Fiott, 2019).

Purchases from the US

The EDIS documents highlights as a concern the increase in acquisitions by EU countries from the US Foreign Military Sales 2 (FMS) programme between 2021 and 2022. During this period, arms exported under this programme from the US to the EU increased by 89 percent. This number is correct 3 , but does not give the full picture, as exports under FMS fell drastically in 2021 (a 59 percent drop compared to 2020), and so simply rebounded in 2022.

Compared to the 2014-2021 average, US exports to the EU under FMS in 2022 were 48 percent higher 4 , in real terms. This appears a reasonable increase given the start of a major military conflict in the immediate vicinity of the EU.

Figure 4: Value of arms exports to the EU under FMS, $ billions, 2015 values

Using the same source, we focus as well on the total arms sales included in the database 5 together with the FMS programme and find that the yearly increase in 2022 was around 58 percent, a number substantially lower than the 89 percent when accounting for the FMS programme alone. Furthermore, even though the trend is upwards, it is more moderate in real terms, suggesting that there has not been an enormous jump in the EU’s military reliance on the US (Figure 5).

Figure 5: Value of total arms exports to the EU from the US, $ billions, 2015 values

Conclusions

We have assessed the value of military purchases from abroad by European countries. We cannot replicate the numbers used in the EDIS proposal (European Commission/High Representative, 2024).

Beyond the question of the numbers, the EDIS plan appears overly protectionist. For example, it states that the trend of increasing purchases from abroad “undermines the competitiveness of the EDTIB and results in EU taxpayers’ money creating jobs abroad,” something that “must thus be reversed”.

Reliance on foreign suppliers in defence product supply chains needs to be addressed, especially in the medium and long-term. The EU should also have a carefully managed strategy of focusing spending on high-tech defence products on domestic firms to boost technological superiority and benefit from positive growth spillovers which may arise from defence technology. However, redirecting weapons purchases to domestic producers as a jobs programme is not an appropriate policy that will result in jobs. Long term value creation can only be assumed if there is a strong long-term growth effect, for example in the case of high-tech goods. There might be a short-term demand effect but in a euro-area economy with very low unemployment numbers, this effect is likely to just attract workers from other businesses. Moreover, a protectionist agenda will invite retaliation from foreign countries with negative effects on exporters.

References

European Commission and High Representative of the Union for Foreign Affairs and Security Policy (2024) ‘A new European Defence Industrial Strategy: Achieving EU readiness through a responsive and resilient European Defence Industry’, JOIN(2024) 10 final, available at https://defence-industryspace.ec.europa.eu/edis-joint-communication_en

Fiott, D. (2019) ‘The Poison Pill: EU Defence on US Terms?’ Brief 7, EU Institute for Security Studies, available at https://www.iss.europa.eu/content/poison-pill-eu-defence-us-terms

Maulny, J. (2023) ‘The impact of the war in Ukraine on the European defence market’, Policy Paper, September, Institut de Relations Internationales et Stratégiques, available at https://www.iris-france.org/wp-content/uploads/2023/09/19_ProgEuropeIndusDef_JPMaulny.pdf

Ministère des Armées (2024) ‘L’excédent commercial lié aux matériels de guerre se contracte en 2022’, EcoDef Statistiques n°240, available at https://www.defense.gouv.fr/ssm/ecodef-statistiques-ndeg240-lexcedent-commercial-lie-aux-materiels-guerre-se-contracte-2022-mars-2024

Ministerio de Defensa (2023) ‘La industria de defensa en España’, Informe 2021, available at https://publicaciones.defensa.gob.es/la-industria-de-defensa-en-espana-informe-2021-libros-ibd.html

Wolff, G. (2024) ‘The European defence industrial strategy: important, but raising many questions’, Analysis, 19 March, Bruegel, available at https://www.bruegel.org/analysis/european-defence-industrial-strategy-important-raising-many-questions

Wolff, G., I. Kharinotov and A. Bushnell (2024), ‘Military procurement in Europe database’, Kiel Institute, forthcoming